Brent is under pressure

Trade ideas

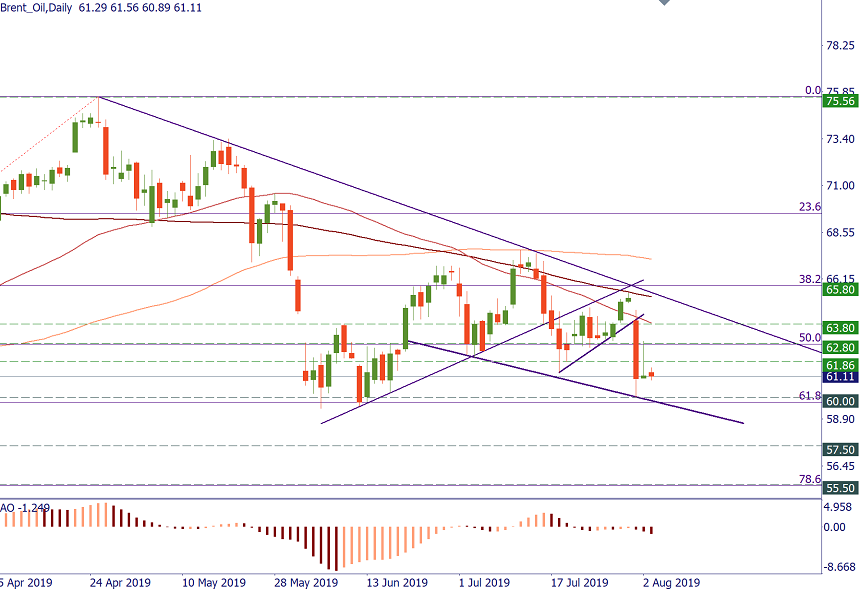

SELL 60.80; TP 60.00; SL 61.00

BUY 61.90; TP 62.80; SL 61.70

Brent oil closed last week below the 100-week MA at 61.86 for the first time since 2018. On D1, the price formed a candlestick with a long upper wick - a sign that bulls didn’t manage to make it close at the day’s high.

There are two contrasting factors that influence oil right now. On the one hand, a tweet from the US President Donald Trump that he would impose a new tariff of 10% on the remaining $300 billion of goods and products coming from China pulls the price of the commodity down. On the other hand, geopolitical tensions in the Middle East make oil appreciate. So far, it seems that the first factor is more powerful. As a result, Brent is likely to test at least the 60.00/59.70 area (psychological level, support line, 61.8% Fibo of the 2018-2019 advance). A break below 59.00 will lead to a bigger decline with targets at 57.50 and 55.50.

The advance above 61.86 is needed to warrant an increase to 62.80 (50% Fibo) and 63.80 (50-day MA).

Notice that to trade Brent, you need to choose BRN-19V in your MetaTrader.