How the Fed may affect the USD?

As you may know, the Federal Reserve will announce its official rate and publish its monetary policy statement today at 21:00 MT time. The release will be followed by the FOMC press conference (21:30 MT time), where the Fed chair Jerome Powell will be answering press questions. This is a highly important event for the Forex market, as it increases the volatility of the USD. Let’s review the projections for today’s meeting and check the key levels for trading EUR/USD.

The throwback to the previous meeting

Back in December, the Fed raised its interest rate to 2.5%, as it was widely expected. However, it lowered the forecasts for the further rate hikes from three to two in 2019. In addition, the long-term projection for the interest rate was pulled down from 3% to 2.8% in 2020. The Fed was very cautious during the previous meeting. The FOMC members mentioned the global economic slowdown, trade truce between the US and China and recession fears as the main reasons for its more dovish tone.

It’s worth mentioning about the recent news regarding the Fed’s balance sheet. There were some rumors about the possible halting of the balance sheet’s reduction. What does it mean for the US economy and the USD in general? Let’s go back 10 years ago to explain this problem. After the financial crisis in 2008, the Fed was conducting the quantitative easing policy, which allowed it to inject cash into the markets by buying different equities and adding them to its balance sheet. As the short-term rates fell to zero during that period of time, the QE policy became the Fed’s primary monetary policy tool. Since then, the financial regulator started to shrink its balance sheet by $50 billion per month. Such a move allows the Fed to tighten its monetary policy and create a similar effect to raising rates. If the Fed pauses the unwinding of its portfolio, it will make the USD less attractive, as the central bank will take its money back from the market. While it’s unlikely for the Fed Chair Jerome Powell to announce any changes to the balance-reduction today, he may provide some hints on this topic during the press conference.

What has happened since the last meeting?

The market has come through a lot of challenges since the last Fed meeting. Firstly, the stock market fell to its last year lows but managed to recover. Secondly, there was a partial government shutdown, which lasted for 35 days. The shutdown made hard for the Fed to assess the economic data, as some of the departments were recently reopened. Let’s not forget about the speech by the Fed Chair earlier in January, who announced the monetary policy by the Fed to be patient and flexible. It made the USD trade lower.

Globally, the International Monetary Fund cut its forecast for the world economic growth in 2019 from 3.7% to 3.5% amid the trade tensions between the US and China.

What to expect from today’s meeting

The Fed will not increase its interest rate this time. However, we need to pay attention to the tone of its statement. If the Fed expresses any uncertainty in the statement concerning the economic outlook for the upcoming months, the USD will be pulled down. But also we need to pay attention to the comments by Jerome Powell during the press conference. His more confident and certain comments on the further steps concerning rate hikes and the quantitative-tightening program will be appreciated by the market, and, therefore, will boost the USD.

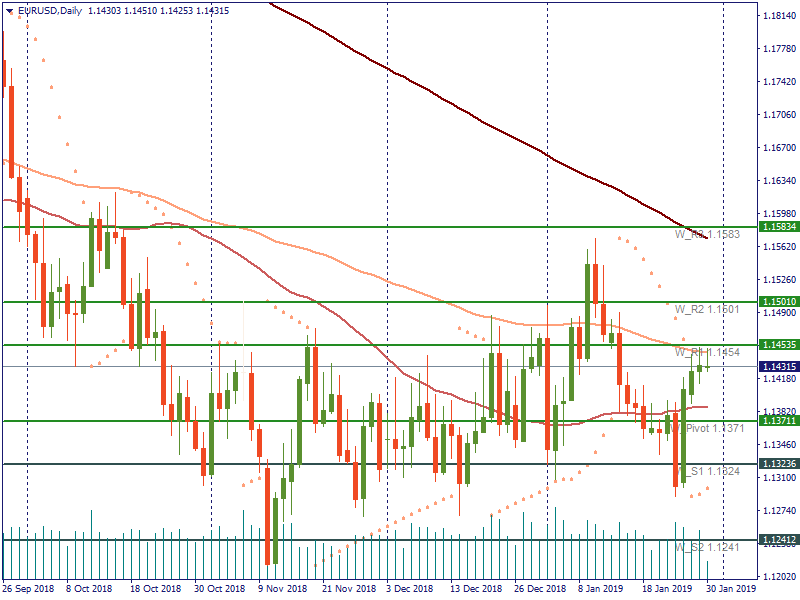

Key levels for EUR/USD

Let's look at how the EUR has been trading against the USD ahead of the Fed meeting. On the daily chart, we can see the current uptrend for the pair, which is confirmed by Parabolic SAR. The pair has already tested the 1.1453 level during the early trading hours, which lies close to the 200-day MA. If the Fed supports the USD today, the pair will fall towards the support at 1.1371. The next support lies at 1.1323. Otherwise, EUR/USD will break the resistance at 1.1453 and move to the next resistance at 1.1501.

What else to wait for the USD this week?

The highly anticipated second round of the trade negotiations between the USA and China starts today. The first round did not result in a breakthrough but listed a lot of topics for further discussions. We wait for the updates on the intellectual rights issue as well as on the extradition of the Huawei chief financial officer Meng Wanzhou to the US, who was arrested on 1 December in Vancouver at the request of the US.

Also, there is a release of non-farm payrolls on Friday at 15:30 MT time. Analysts anticipate a decline to 165 thousand payrolls from 312 thousand. If the actual level is higher, the USD will be supported and EUR/USD will fall.

As we can see, this week is very busy for the US Dollar and today may provide you a chance to trade the USD. Do not underestimate the wonderful opportunities to trade EUR/USD with FBS!