JPY: Bulls Eagerly Await the BOJ’s Move

The yen has experienced significant fluctuations in recent weeks, initially gaining ground against the weakening US dollar in December but subsequently losing those gains as the dollar rebounded in January. USD/JPY reached 148.80 on Friday, the highest level since November 28, prompting concerns that if the yen continues to depreciate, the Ministry of Finance might intervene to support it, especially if it breaches the 150 level.

The upcoming policy meeting of the Bank of Japan (BoJ) on Tuesday adds a layer of uncertainty. While the market does not anticipate a change in policy settings, surprises from the BoJ are not unprecedented. Although expectations are for the BoJ to eventually move away from negative interest rates, the prevailing economic conditions, recent earthquake impacts, and upcoming national wage negotiations in March suggest that the April meeting might be more conducive for significant policy announcements. Even if the BoJ maintains its current stance in the upcoming meeting, investors will closely analyze various factors, including updated inflation reports and quarterly economic projections.

CADJPY - D1 Timeframe

CADJPY on the Daily timeframe seems to be setting up for a reversal in the trend. From the price action on the chart, it is evident that price is currently trading within a supply zone, with a likely QMR (Quasimodo Reversal) being formed. The presence of a trendline that overlaps the supply zone serves as an extra confirmation of the bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 108.631

Invalidation: 110.732

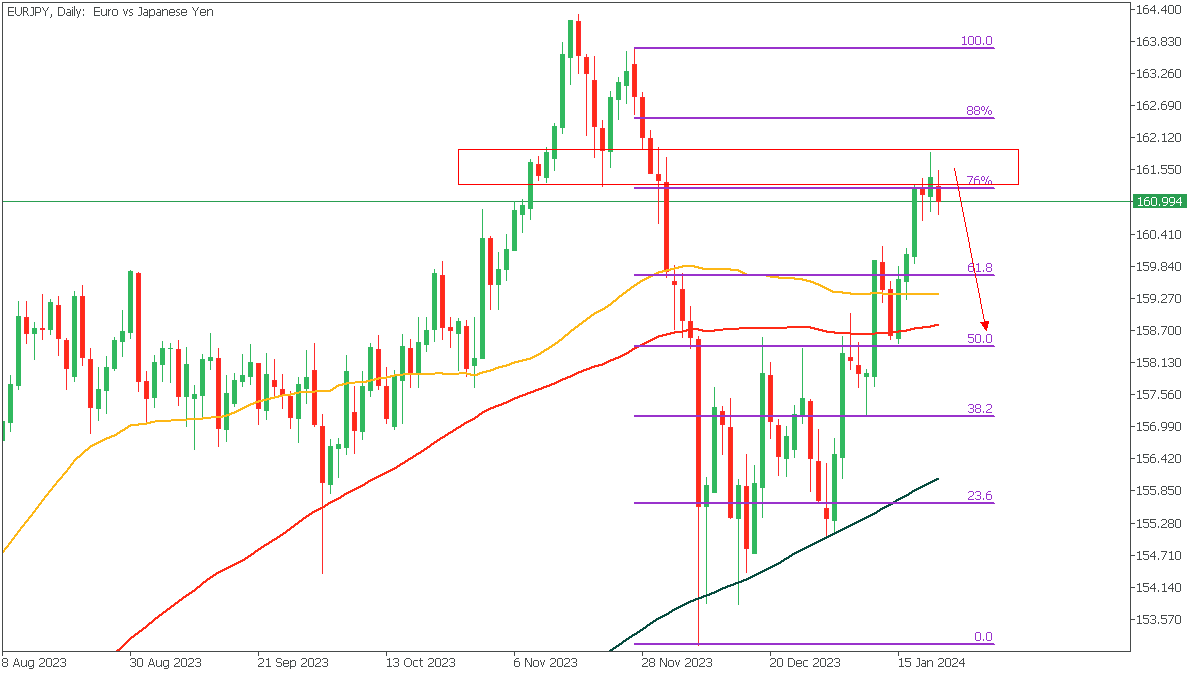

EURJPY - D1 Timeframe

EURJPY is currently trading around 76% of the Fibonacci retracement and can be seen to be under a lot of bearish pressure from the supply zone. On the lower timeframes, I would prefer to see a clear break of structure in order to confirm the validity of my sentiment - remember that.

Analyst’s Expectations:

Direction: Bearish

Target: 158.762

Invalidation: 161.976

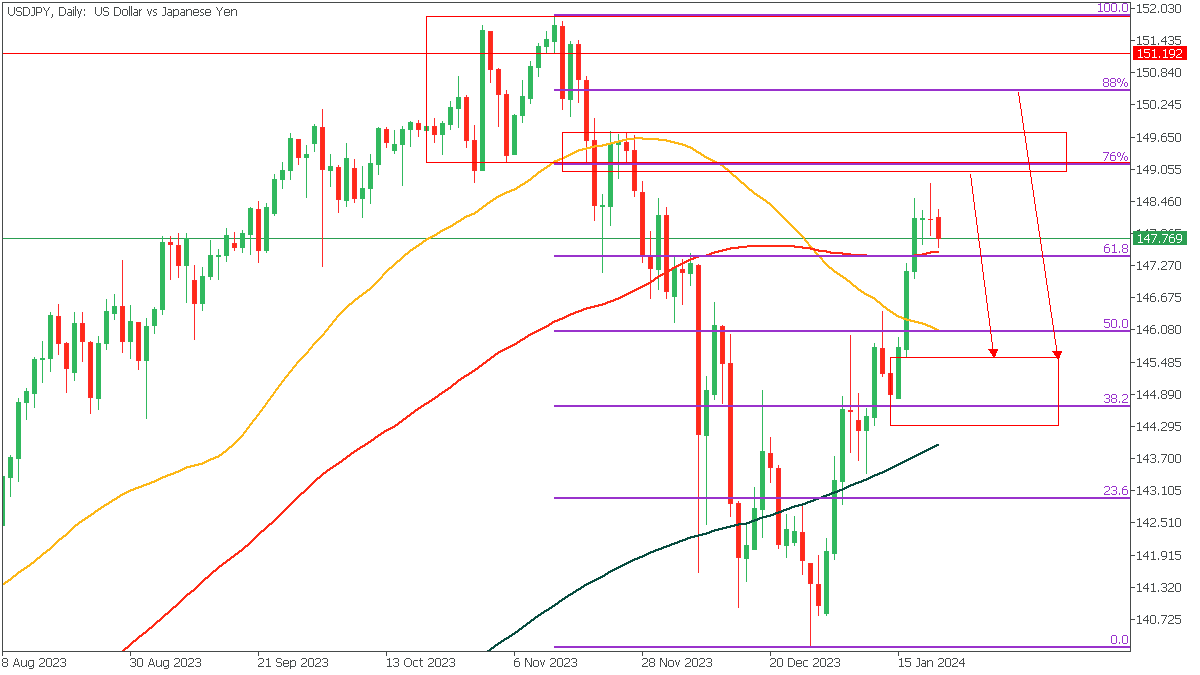

USDJPY - D1 Timeframe

As for USDJPY, I have two key areas of interest that I will be watching keenly. I want to patiently watch for the reaction that price ends up making at either of these levels before taking my entry. As you can tell, both areas sync well with the 76% and 88% of the Fibonacci retracement level, so we can wait to confirm which of the two presents a stronger case.

Analyst’s Expectations:

Direction: Bearish

Target: 145.662

Invalidation: 149.832

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.