JPY: the Forex market reconquest

Key indicators

Performance in 2020: +2.4%

Last day range: 109.55 – 110.44

52-week range: 104.46 – 112.40

Yellow-zone alert

Now that the Coronavirus is reducing its pace of expansion inside China and increasing its conquest globally, the markets woke up to the probability of having it at a pandemic level. The USD is no longer a bastion of safety as it used to be just until recently, and a pre-panic mode is engulfing the Forex market. For the JPY, it means getting back at the pedestal of safe-haven and enjoying high demand from currency investors. The Japanese yen is performing well against most of its counterparts, and the USD/JPY is the most vibrant example of it.

JPY is changing gears

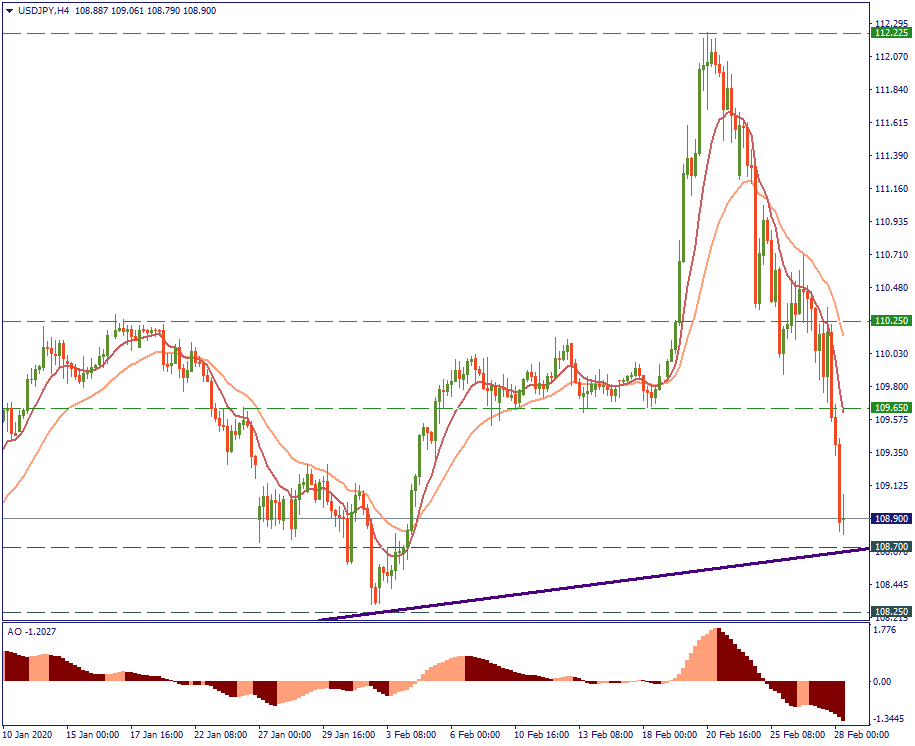

The USD/JPY finally left the corridor of 109.65-110.25 where it takes rest from time to time since the virus broke out. Currently, it trades at 108.96, which flirts with the support of 108.70 and comes to test the mid-term upward trend of the currency pair. Going below 108.70 would mean the currency pair aims at 108.25 – if it’s there, it means the mid-term tendency of USD’s appreciation against the JPY is broken. But it will take a while before that. This Friday, we are likely to see the support of 108.70 tested; next week, the downside corridor between 108.25 and 108.70 will be in the agenda.

Technical levels

Support 108.25

Resistance 109.65