TRADE IDEA: What's Next for Yen Crosses?

AUDJPY

The wedge scenario on AUDJPY is such that the upper trendline dates as far back as September, whilst the trendline support dates even farther. As a result, the trendline with the most touches is naturally expected to be the weaker one, and thus, my bias for a bearish breakout. The real impulse is expected to begin after the breakout of the wedge.

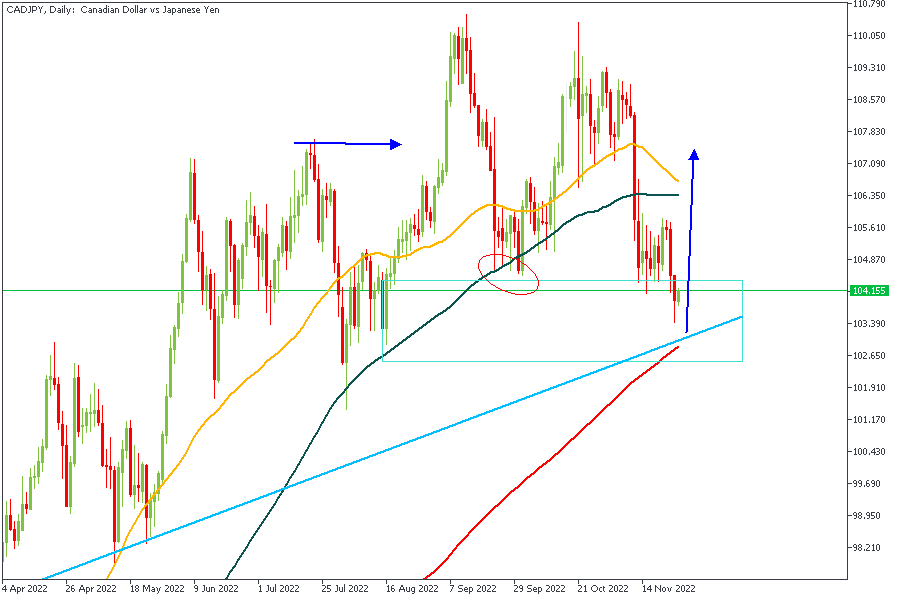

CADJPY

After the bullish break of structure that occurred at the horizontal blue arrow, we can see that price retraced lower and liquidity was taken out at the circled region. Based on these schematics from an SMC (Smart Money Concept) point-of-view) the area between 104.5 and 102.0 is expected to act as a drop-base-rally demand zone. Coupled with the trendline support, 200-day Moving Average, and the 88.2% Fibonacci retracement zone, I am expecting a bullish reaction from the marked zone, possibly to the 107 area.

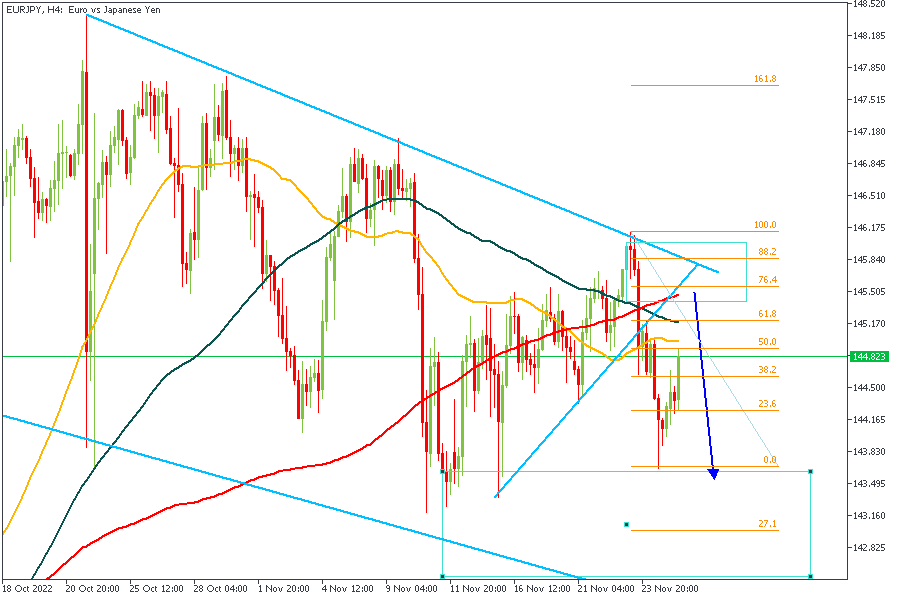

EURJPY

EURJPY can be seen trading within this huge wedge with a recent bearish break of structure as well as a break of the internal trendline. Based on these factors, the current bullish impulse can be considered a retracement. The marked rectangular zone at the 76.4% retracement level is my expected area of interest since a confluence of other important factors like the 200-SMA, 50-SMA, and internal trendline retest all align around the area.

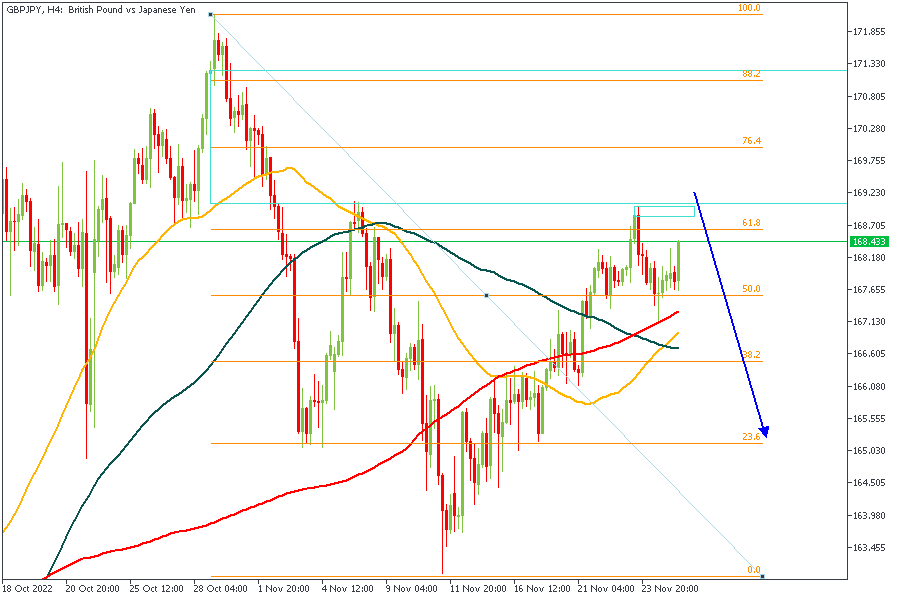

GBPJPY

GBPJPY is currently approaching a major supply zone as spotted on the Daily timeframe. There is a possibility of a temporary bullish impulse in the meantime in order to clear out liquidity from the equal highs. We can therefore expect to see a bearish continuation from the 76.4% retracement area.

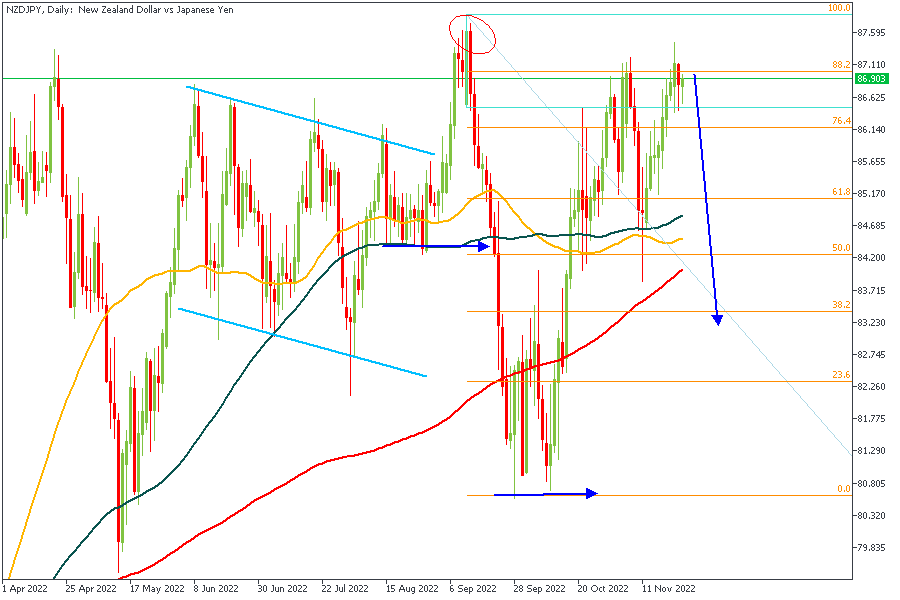

NZDJPY

NZDJPY seems to be seeking to complete the AMD (Accumulation-Manipulation-Distribution) schematic which means we can expect a bearish impulse from within the current rally-base-drop supply zone to move toward the 200-MA.

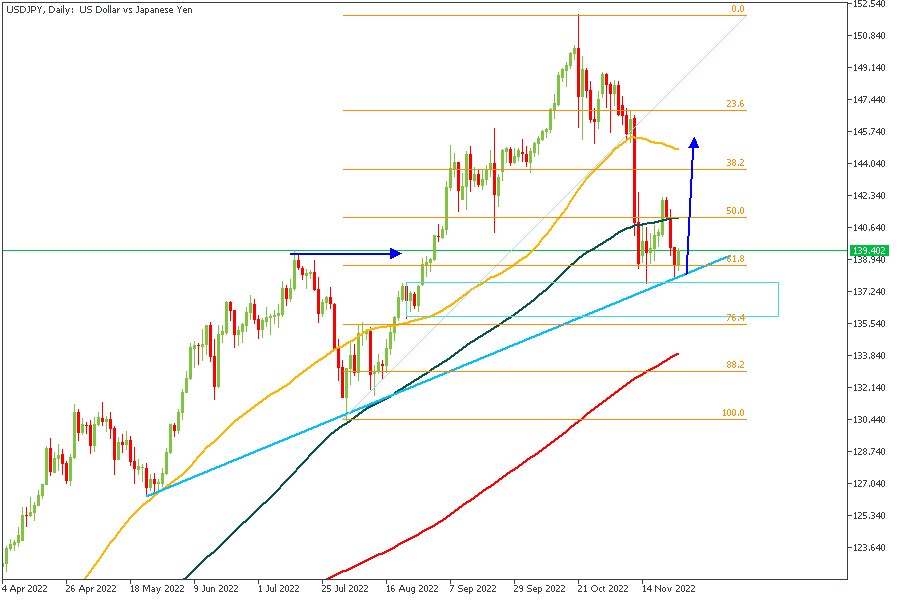

USDJPY

The previous break of structure on USDJPY as seen from the horizontal blue arrow on the chart above is bullish. Right now we're seeing a retest of the rally-base-rally demand zone that aligns perfectly with the trendline support and the 61.8% retracement level. This means that we can expect to see some bullish impulse from USDJPY going into the new week.

CONCLUSION

The views above are solely based on Technical Analysis techniques using my personal Smart Money approach. Hence, it is important to understand that the trading of CFDs comes at a risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.

Log into your dashboard or create an account here to get started.