What may determine the direction of oil prices?

The fears about the global economic slowdown have deepened this week and affected the risk sentiment in the market. As a result, the oil prices fell.

Will this situation put an end to the bullish optimism in the oil market? What should oil traders expect next? Let’s find out the answers to these questions.

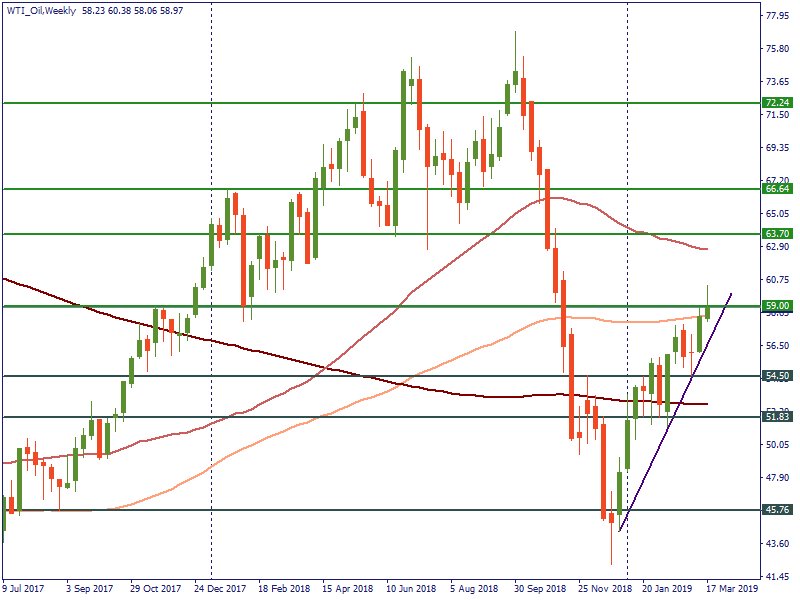

At first, let us look at the long-term picture for oil prices.

Bullish factors

After the dramatic drop of the oil prices at the end of 2018, the members of the Organization of the Petroleum Exporting Countries (OPEC) together with non-OPEC producers (the Joint Ministerial Monitoring Committee) agreed to cut oil production by 1.2 million barrels per day. The decision has supported the prices for crude oil since the beginning of the year. Earlier this week, the cartel said about the possibility to cancel its meeting in April after a brief discussion in Azerbaijan. According to the words of the OPEC’s energy minister Khalid al-Falih, the oil market looks oversupplied until the end of 2019 and April meeting is an early deadline for changing the production policy. His comments increased the possibility of the extension of production cuts until the end of the year. It is also worth mentioning the upcoming production cuts from Russia, Iraq, and Kazakhstan in the next two months.

The next regular OPEC’s talks are scheduled on June 25-26. Until then, we may expect oil prices to be supported.

Also, the ongoing US sanctions against Iranian and Venezuelan crude oil exports have brought a lot of optimism to the oil bulls. Reportedly, the Iranian oil exports have fallen in March to their lowest daily level this year. The news came out ahead of the US decision on further sanctions to Iran in early May. If Iran is more restricted in oil production and exports than now, it will also push the crude prices higher. As for Venezuela, the crisis continues there, which means that the US sanctions against the state-owned oil and natural gas company PDVSA will also help the prices for oil to rise.

At the same time, there are some threats, which may hurt the oil market in the near future.

Bearish factors

One of the main factors, which may pull the oil prices lower soon, is connected with the global economic outlook. The slowdown of the production and exports in China, as well as the weak data for Europe released on Friday, spooked investors and traders and lowered the demand for black gold. Analysts mention the trade tensions between the US and China as the key reason behind this situation. Despite positive comments by US president Donald Trump on the good path of trade talks, the sides are not quite close to the final deal. As a result, the uncertainties affect the risk sentiment.

The unpredictable Trump administration may shake the oil market, too. We are talking not only about the famous Twitter account of Mr. Trump. In May, the US will decide on the extension of waivers, which allow countries to buy Iranian oil. Up to now, there are eight waivers given to the key customers of Iranian oil, including China, India, Japan, and South Korea. The government will likely extend the waivers to some of the customers, as it does not want to push oil prices too high. Let’s not underestimate the No Oil Producing and Exporting Cartels Act, also known as NOPEC. The proposed law would allow the government to pursue a lawsuit against any oil producing country that is engaged in agreements with other oil producers on limiting oil production. The bill is currently under review in the US Senate. OPEC leaders already warned the markets that if the bill is approved, the counties will boost the oil production to the maximum. The main question now is whether the US president supports this bill or he does not want to ruin the relationships with OPEC majors like Saudi Arabia and the United Arab Emirates. That is why it is highly important to follow the updates on this situation.

The factors listed above show us that the bullish scenario will likely continue until May or June unless the US surprises us with a fresh law or changes its policy concerning sanctions.

What about the key levels for this long-term scenario? On the weekly chart of WTI, we can clearly see the uptrend since the beginning of the year. The price has managed to stick above the 100-week SMA last week but failed to overcome the resistance at $59. If bulls continue to dominate in the market, they will break this level next week and move towards the next resistance at $63.70. The next target for bulls lies at $72.24. On the other hand, if the global slowdown increases fears in the market, the price for WTI will fall to the support at $54.5. The next support is placed at $51.83. The break of this level will help bears to focus on the lower target at $45.76.

The long-term forecast is a good thing to follow and trade on, but let’s look at the short term opportunities for the next week.

At first, we need to follow the updates on the trade talks between the US and China on March 28-29 in Beijing. If positive news on reaching the deal soon comes out, it will help the risk sentiment in the market to recover and push the oil prices as well.

Secondly, pay attention to the tweets by Donald Trump, which may pull the oil prices, if he says they are “too high”.

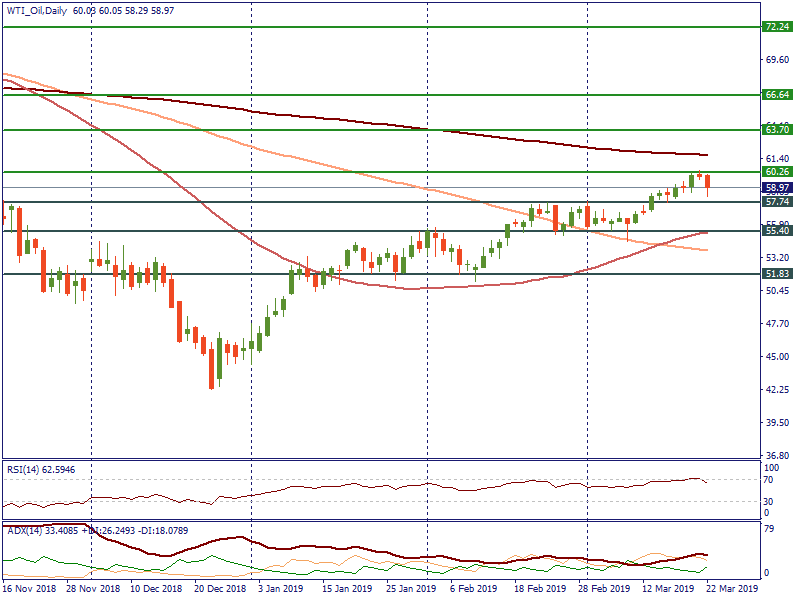

Now, let’s look at the daily chart of WTI. The price for crude oil bounced from the resistance at $60.26 and started to fall towards the support at $57.74. If the uncertainties in the market result in risk aversion, bears will try to break the $57.74 level and pull the price for black gold lower to the next support at $55.4. If the bullish optimism in the market continues, we will see the rise above the $60.26 level to the resistance at $63.70. If we look at indicators, RSI left the overbought zone and provided a short-term sell opportunity. ADX shows the strength of bulls.

To conclude with, it is worth to mention that the possible signal for lower prices may come from either the news about the slowdown of the global economy or the US administration. Besides that, the fundamental picture of the oil market looks bullish at least for a couple of months.