A countertrend trading strategy is an attempt to make a small profit by opening a trade against the main trend. Countertrend trading is a form of swing trading that assumes that the current market trend will experience reversals or pullbacks and then attempts to profit from those pullbacks as the underlying trend continues. This strategy is medium-term, where positions are held for a few days or weeks.

Some traders who use this strategy for profit use pullbacks while maintaining their main positions in the direction of the trend. Countertrend strategies use momentum indicators, support and resistance levels, and candlestick patterns to identify possible market entry points. However, traders using this method must be prepared to resume the current trend at any time without warning. Thus, when trading with this strategy, proper risk management techniques such as stop-loss orders and minimum position sizes should be used to limit losses.

Traders using this approach take hints from reversal candlestick patterns (pin bars, evening/morning stars, etc.). They also apply oscillators like MACD or RSI to see whether the market has become overbought/oversold and whether there’s a divergence between the price and the indicator. If these signs are present, traders open positions against the previous trend.

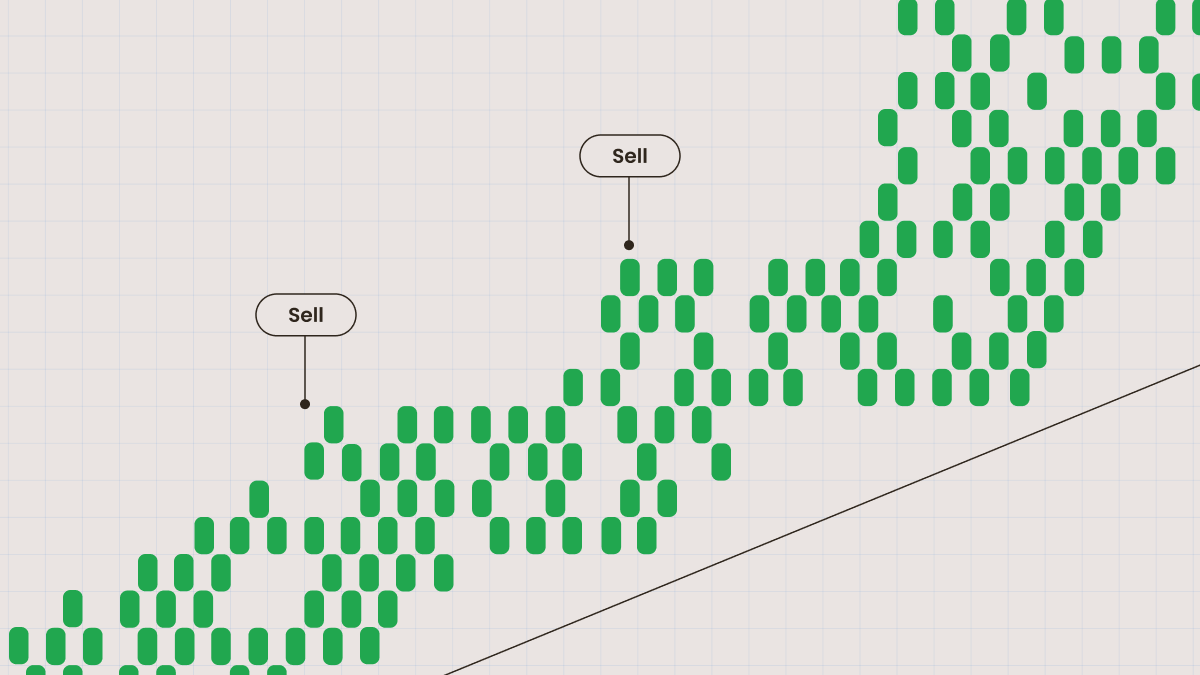

A trader may decide to sell at Point 1 as the price formed a candlestick with a long upper shadow (a negative sign) and the MACD indicator didn’t confirm the price’s high.

Take-profit

It’s harder to find a place to fix profit when you’re trading on a countertrend. The challenge is not to get too greedy. Remember that you’re betting against the market. Some trends can turn into a sideways market, limiting the profits from a countertrend position. The initial trend can also resume fast and not let the price correct too much. Be careful and manage your risk.

Stop-loss

The location for a stop-loss order in a trade like this is natural. Traders put their stop-losses behind the extreme point of the price, from which a correction has started. The stop-loss will likely be smaller than the one you would use if you were trading on the main trend.

Scaling in

It’s not a good idea to meddle with your position size when you trade on a countertrend. The trade can be very short-term, so you risk getting yourself in an uncomfortable position if you try to add to a trade. And never add to a losing position, as this is likely to lead to a bigger loss.

In our new video, we’ll discuss trend trading and countertrend trading more precisely.

Summary