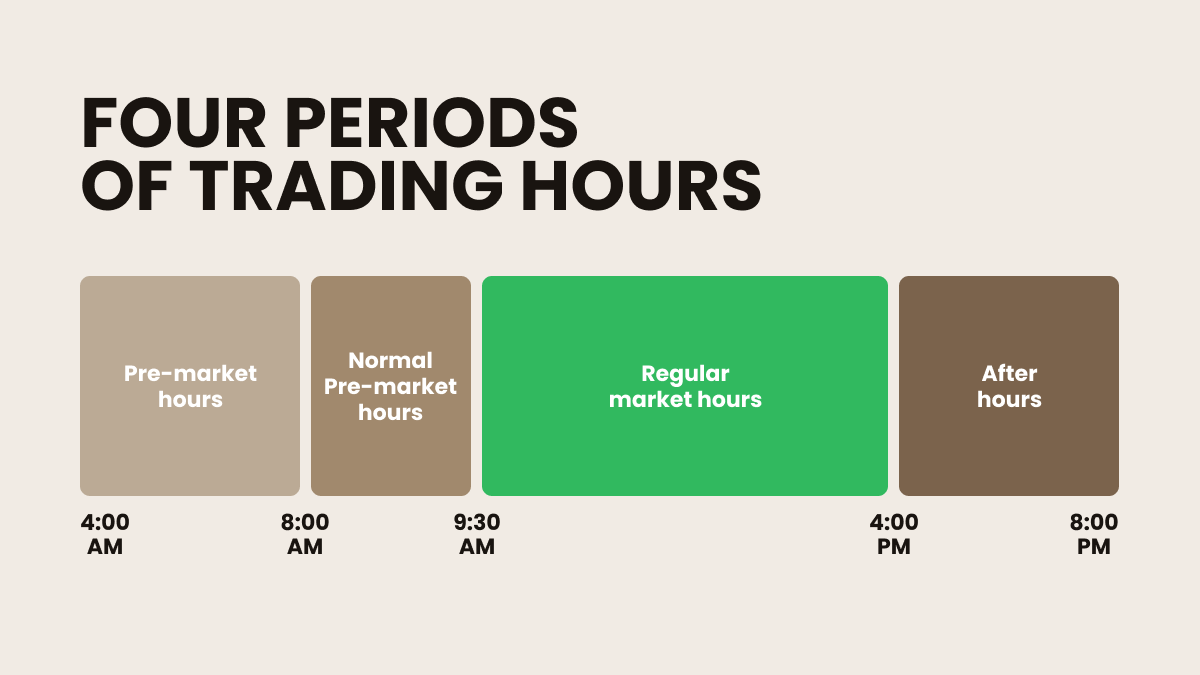

Who can trade after hours?

After-hours trading started in 1999. At that time, most stock exchanges introduced electronic communication networks (ECNs — a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges). With ECNs, traders and investors do not need to place orders personally in the stock exchange building.

Nowadays, most market participants use extended trading sessions to react to news more quickly than others do. Examples of such news are:

Pre- and after-hours trading is available only for stock traders and only with certain brokers. Because of regulation and safety measures, CFD brokers offer this option way less often.

As for bigger players, an extended session is a perfect time for smart money to act. For example, insiders and hedge funds often use pre- and after-hours trading times to fulfill their orders via so-called dark pools (a privately organized exchange for trading securities). Dark pools allow institutional investors to trade without exposure until after the trade has been executed and reported.

After-hours trading risks

The off-market trading period has fewer participants, leading to specific risks traders should be aware of:

-

Lower liquidity and higher volatility: Pre- and after-hours markets typically experience reduced liquidity, increased volatility, and lower trading volume. These factors can significantly impact the price received for shares. To mitigate this risk, it’s advisable to use limit orders when trading outside regular hours.

-

Pricing risk: During regular sessions, trades are executed at the best available price across multiple ECNs. In after-hours trading, orders may be routed through a single broker, potentially leading to less favorable prices. However, these price discrepancies between brokers can offer arbitrage opportunities.

-

Limited market depth and price swings: With fewer participants, the market depth is smaller after hours. In response to breaking news, stocks can experience sharp and unpredictable price movements as the market recalibrates. Retail investors may find it harder to execute orders at desired prices and might secure better prices during the next regular session.

Benefits of after-hours trading

However, trading after hours also has a number of advantages that can provide traders with unique opportunities:

-

Reacting to market-moving news: Extended sessions allow you to trade on breaking news before the regular market opens. Events like mergers, takeovers, bankruptcy filings, or key economic reports (e.g. unemployment data) can move stock prices significantly. Acting swiftly in after-hours trading can help you capitalize on these price movements ahead of other market participants.

-

Arbitrage opportunities: Arbitrage involves profiting from price discrepancies of the same asset across different brokers. While prices usually align quickly during regular trading hours, after-hours sessions can present temporary divergences. This makes extended trading periods a rare window where arbitrage opportunities can persist longer than a split second, offering potential profits for sharp-eyed traders.

To sum up, premarket and after-hours trading have their pros and cons. With the understanding of extended sessions and how to use them, you may find new trading opportunities. But be aware of the risks. Trade safely, good luck!