The most common Forex scams

In the world of Forex, it is essential to recognize unfair trading practices whether you are a seasoned trader or a newbie. This section highlights the most common Forex scam tactics to help traders identify and protect themselves against unfair activities in the market.

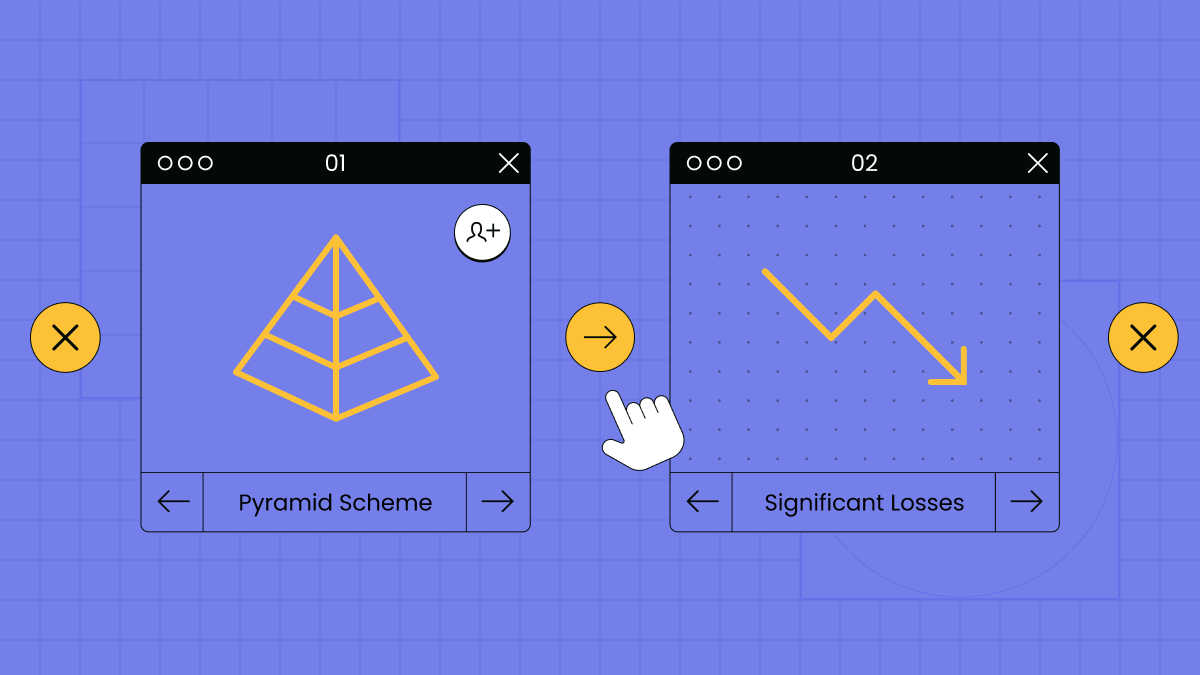

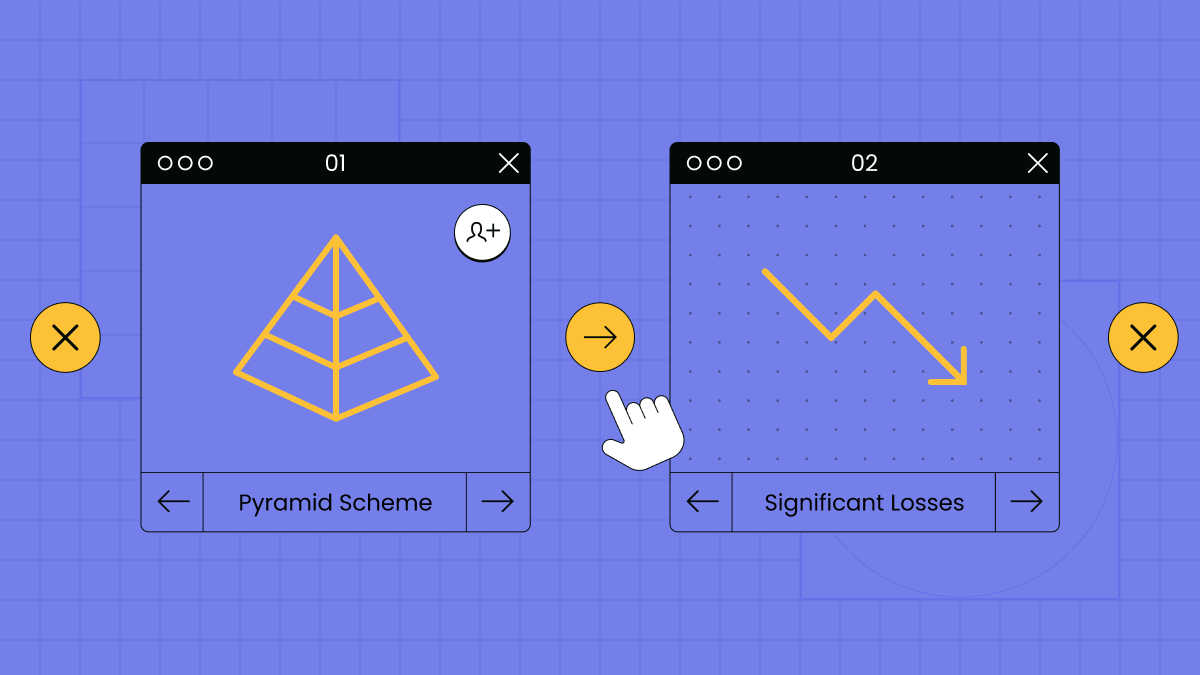

Pyramid schemes

Pyramid schemes are a form of financial fraud that has infiltrated the Forex industry. They entrap individuals with promises of massive profits. Pyramid schemes exist under the cover of legitimate investment opportunities. The founders operate as funds where capital is gathered to make investments on behalf of clients. This type of fraudulent activity is based on recruiting new participants who have to make an initial investment, with the promise of substantial returns through recruiting others into the scam scheme. The focus of pyramid schemes is precisely recruiting more members, and not trading practice. Such pyramids grow until they suddenly collapse, causing significant losses for defrauded investors.

Here are the red flags common for pyramid schemes in Forex:

- guarantee of significant returns;

- lack of actual trading activities;

- pressure to bring in new members in order to get a payment.

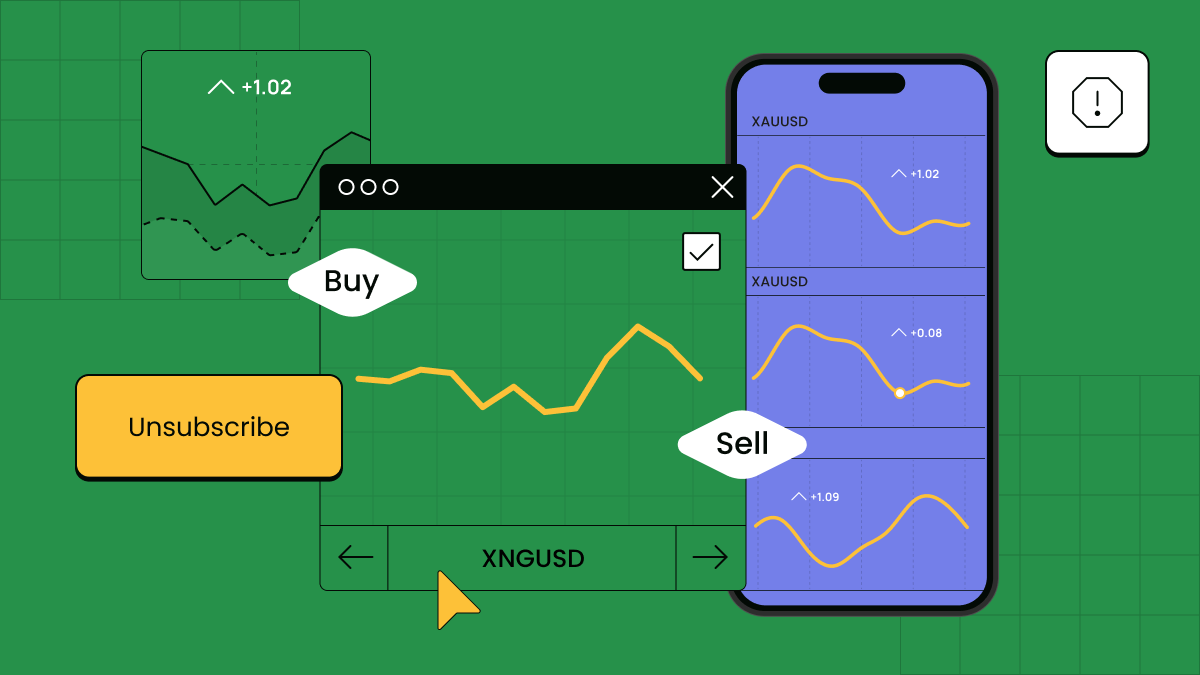

Signal service scam

Signal service scams in Forex are widespread schemes where individuals or companies guarantee they will provide reliable and accurate trading signals to traders for a fee. However, these fraudulent providers fabricate the signals, which results in substantial losses for unsuspecting victims.

In signal service scams, wrongdoers capitalize on traders’ desire to make easy profits by relying on the expertise of others. They often use attractive marketing tactics and create a false perception of success to find subscribers. Once traders sign up and pay the subscription fees, they receive randomly generated signals deliberately designed to manipulate them into entering losing trades.

The typical actions intrinsic to Forex signals scammers:

- persuading you that Forex trading is easy and you can achieve overnight wealth without any effort or skills;

- requiring upfront payments without providing any verifiable proof of their signal performance;

- engaging in aggressive marketing tactics such as cold calling or spam emails to target inexperienced traders;

- offering bonuses to lure new customers and expand their network;

- failing to provide consistent signal updates, resulting in delayed or outdated information.

So, if someone offers you the opportunity to get rich quickly, they will most likely get rich at your expense, leaving you with nothing.

Managed Forex account scams

Managed trading account scams in Forex involve offering fraudulent services to manage traders’ funds on their behalf. Typically, scammers present themselves as professionals providing false information about successful trading records. They attract traders by making promises of high returns and minimal risk.

To participate in the scheme, scammers ask traders to deposit a significant amount of money into a managed account, persuading them to use it for Forex trading under the expertise of their team. By providing traders with false reports and statements, the fraudsters create an illusion of active trading. They can even give traders online access to a trading platform that demonstrates false trades and fictitious profits.