Fundamental Factors Impacting Markets

- Tariff Chaos Dominates Headlines

- U.S. Tariff Changes:

- Universal import rate cut to 10% (except for China)

- China hit with 145% tariffs – confirmed by White House

- China's Retaliation:

- Boosted tariffs on U.S. goods from 84% → 125%

- Chinese finance ministry warned tariffs are becoming an economic "joke."

- Other Tariffs Still in Effect:

- 25% tariffs on aluminum, autos from Canada & Mexico (outside USMCA)

- 145% on China

- 10% on all other countries

- U.S. Tariff Changes:

- Uncertainty Remains Despite Diplomatic Moves

- EU's trade rep flying to Washington Sunday to potentially "sign deals"

- There is no clarity on whether the 90-day tariff reprieve will stick or expire with more chaos

- Analysts and fund managers warn temporary tariff pauses are not a resolution

- Economic Fallout

- Investors fear long-term inflation + slower growth

- Businesses and consumers lack confidence with short-term reprieves

- Jed Ellerbroek (Argent Capital): "Policies = higher inflation, lower growth, frustrated market."

- Market Sentiment Swings

- Traders switching rapidly between risk-on (Wednesday rally) and risk-off (Thursday plunge)

- Significant indices remain 7.1% down since the April 2nd tariff announcement

- High volatility likely to persist as policy headlines drive intraday momentum

Key Takeaway for Traders

- Markets are trying to stabilize after one of the most volatile weeks in years, but headline risk from tariffs is not priced in the long term.

- Relief rally may continue Friday if EU-U.S. trade news is positive, but the risk remains heavily skewed to the downside if talks stall or China retaliates further.

US100 – H4 Timeframe

.png)

The bullish break of structure on the 4-hour timeframe chart of US100 created a Fair Value Gap and was followed by a bearish retracement. In such scenarios, price is expected to be attracted to the FVG area, after which a reaction from the demand zone would serve as the entry confirmation. In this case, the highlighted demand zone overlaps the trendline support and serves as a critical area of confirmation.

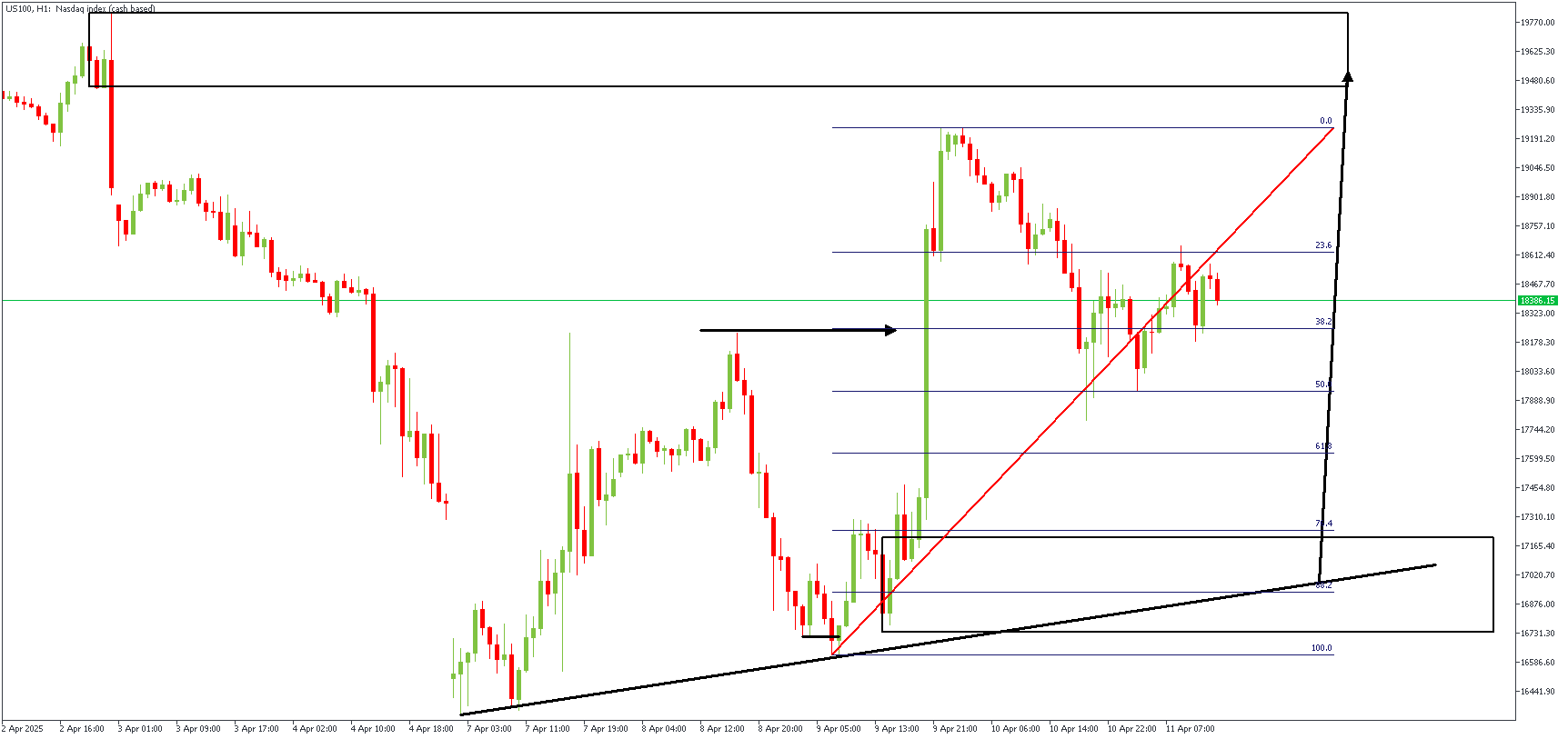

US100 – H1 Timeframe

The 1-hour timeframe chart reveals the SBR pattern lurking behind the drop-base-rally demand zone. We also discover that the demand zone falls within the 76%- 88% Fibonacci retracement levels, another confirmation of bullish intent. Finally, trendline support is the final piece that brings the puzzle together.

Analyst's Expectations:

Direction: Bullish

Target- 19443.88

Invalidation- 1647.80

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.