จะเทรดการดึงกลับของแนวโน้มยังไงดี

การดึงกลับคืออะไร?

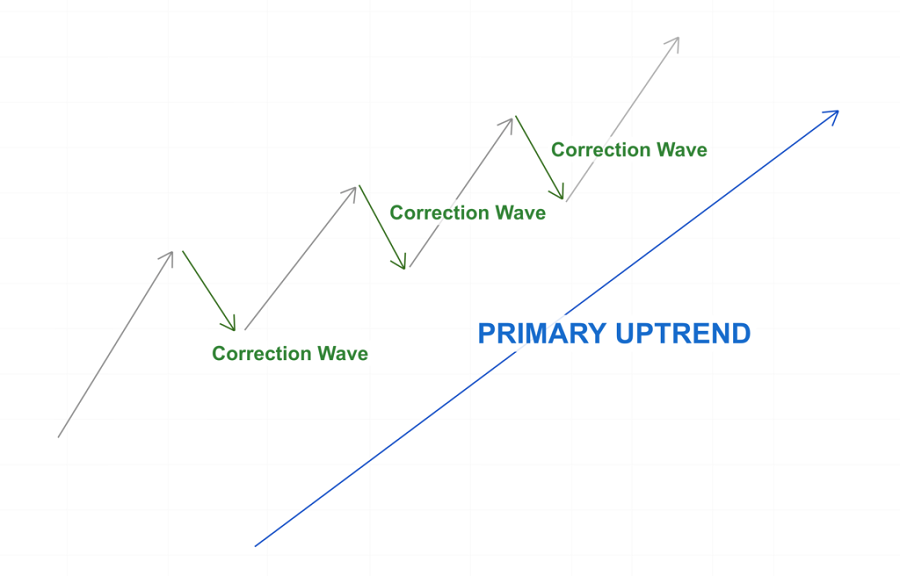

ราคาไม่เคยวิ่งเป็นเส้นตรง โดยปกติ การเคลื่อนไหวของราคาจะถูกเรียกอีกอย่างว่าคลื่นราคา ในช่วงที่เกิดแนวโน้มที่แข็งแกร่ง ทุกระดับสูงสุดถัดไปจะต้องสูงกว่าระดับก่อนหน้า และระดับต่ำสุดถัดไปก็ควรสูงกว่าระดับก่อนหน้าด้วยเช่นกัน

ในภาพด้านบน จะแสดงตัวอย่างที่สมบูรณ์แบบของแนวโน้มขาขึ้น ดังที่คุณเห็นว่ามีคลื่นปรับฐานสามระลอก ซึ่งทำให้เทรดเดอร์สามารถเข้าสู่ตลาดขาขึ้นที่แข็งแกร่งได้

ในบทความนี้ เราจะพูดถึงวิธีการเลือกจุดที่ดีที่สุดเพื่อเข้าสู่ตลาดระหว่างการปรับฐาน

ทฤษฎีเทรนด์ไลน์ของ John Heels

เทรนด์ไลน์เป็นเครื่องมือการซื้อขายที่ดีที่สุดตลอดกาล แม้แต่เทรดเดอร์ที่สาบานว่าจะเลิกใช้ตัวบ่งชี้ก็ยังวาดมันเลย

โดยทั่วไปแล้ว การดึงกลับที่อ่อนแอจะชี้ถึงความแข็งแกร่งของแนวโน้ม แต่ในทางกลับกัน การดึงกลับที่แข็งแกร่งกว่าจะส่งสัญญาณการกลับตัวของแนวโน้มที่กำลังจะเกิดขึ้น

John Hill นักเขียนด้านการเทรดที่มีชื่อเสียง ได้สร้างทฤษฎีเทรนด์ขึ้นมา ทฤษฎีนี้เรียบง่าย เทรดเดอร์ต้องวาดเส้นสัญญาณเทรนด์เพียงสองเส้นเพื่อกำหนดพลังของเทรนด์

ขั้นแรก คุณต้องเรียนรู้วิธีวาดเส้นสัญญาณ

- วาง 0 ไว้ที่จุดสุดขั้ว

- วาง 1, 2, 3, 4 ตามภาพด้านล่าง

เชื่อมต่อ 0 และ 4, 0 และ 2

หากระหว่างแนวโน้มขาขึ้น เส้น 0-4 สูงชันขึ้น และการดึงกลับมีพลัง จงเลี่ยงเทรดการดึงกลับนี้

หากระหว่างแนวโน้มขาขึ้น เส้น 0-2 สูงชันขึ้น แต่การดึงกลับไม่มีพลัง คุณอาจเปิดคำสั่งซื้อ long ตามที่แสดงในภาพ (เมื่อราคาทะลุเส้น 0-4)

คุณอาจใช้ตัวอย่างนี้ในช่วงขาลงได้เช่นกัน

Breakout pullback

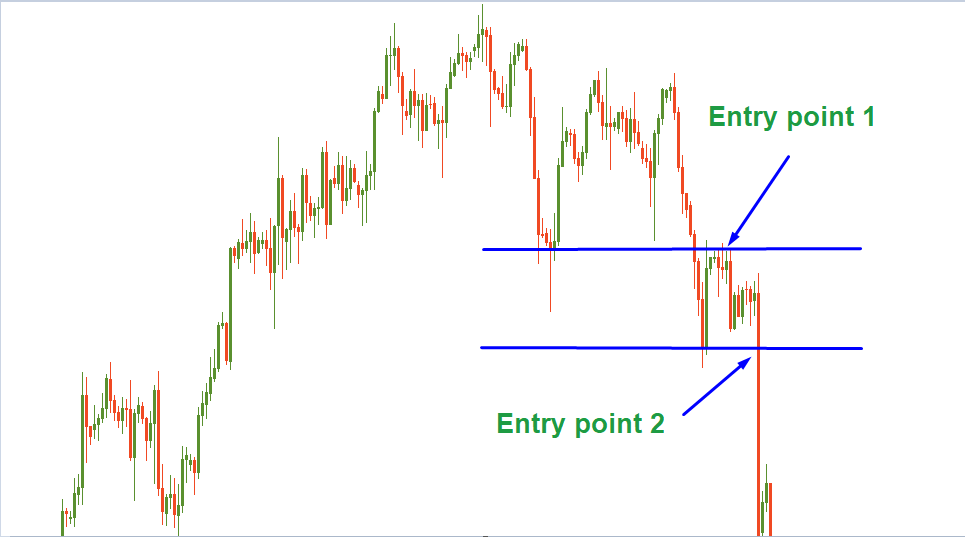

Breakout pullback เป็นหนึ่งในกลยุทธ์การดึงกลับที่ได้รับความนิยมมากที่สุด กลยุทธ์นี้มีประสิทธิภาพสูงสุดที่จุดเปลี่ยนของตลาด ในช่วงแนวโน้มที่แข็งแกร่ง ราคาอาจรวมตัวในช่องและสร้างระดับแนวรับและแนวต้าน

ในภาพ คุณจะเห็นว่าราคาทะลุผ่านระดับแนวรับแรก (เส้นสีน้ำเงินด้านบน) และทดสอบซ้ำจากด้านล่าง (หลังจากที่ทะลุออกไป ราคามักจะกลับสู่ระดับที่มันทะลุผ่าน) ในช่วงเวลาของการกลับไปทดสอบ เทรดเดอร์ที่ดุดันอาจเปิด short ในกรณีนี้ อัตราส่วนผลตอบแทน/ความเสี่ยงที่เป็นไปได้จะสูงที่สุด เนื่องจากราคาอาจไปอยู่เหนือระดับแล้วขึ้นต่อ

เทรดเดอร์ที่ระมัดระวังควรรอจนกว่าราคาจะวิ่งต่อในโครงสร้างแนวโน้มแล้วทะลุผ่านจุดต่ำสุดใหม่ (การทะลุผ่านเส้นสีน้ำเงินที่อยู่ต่ำกว่า) นั่นคือจุดเข้า sell จุดที่สอง การเข้าแบบอนุรักษ์นิยมจะเกิดขึ้นในภายหลัง ดังนั้นอัตราส่วนผลตอบแทน/ความเสี่ยงที่อาจเกิดขึ้นก็จะน้อยลงเช่นกัน

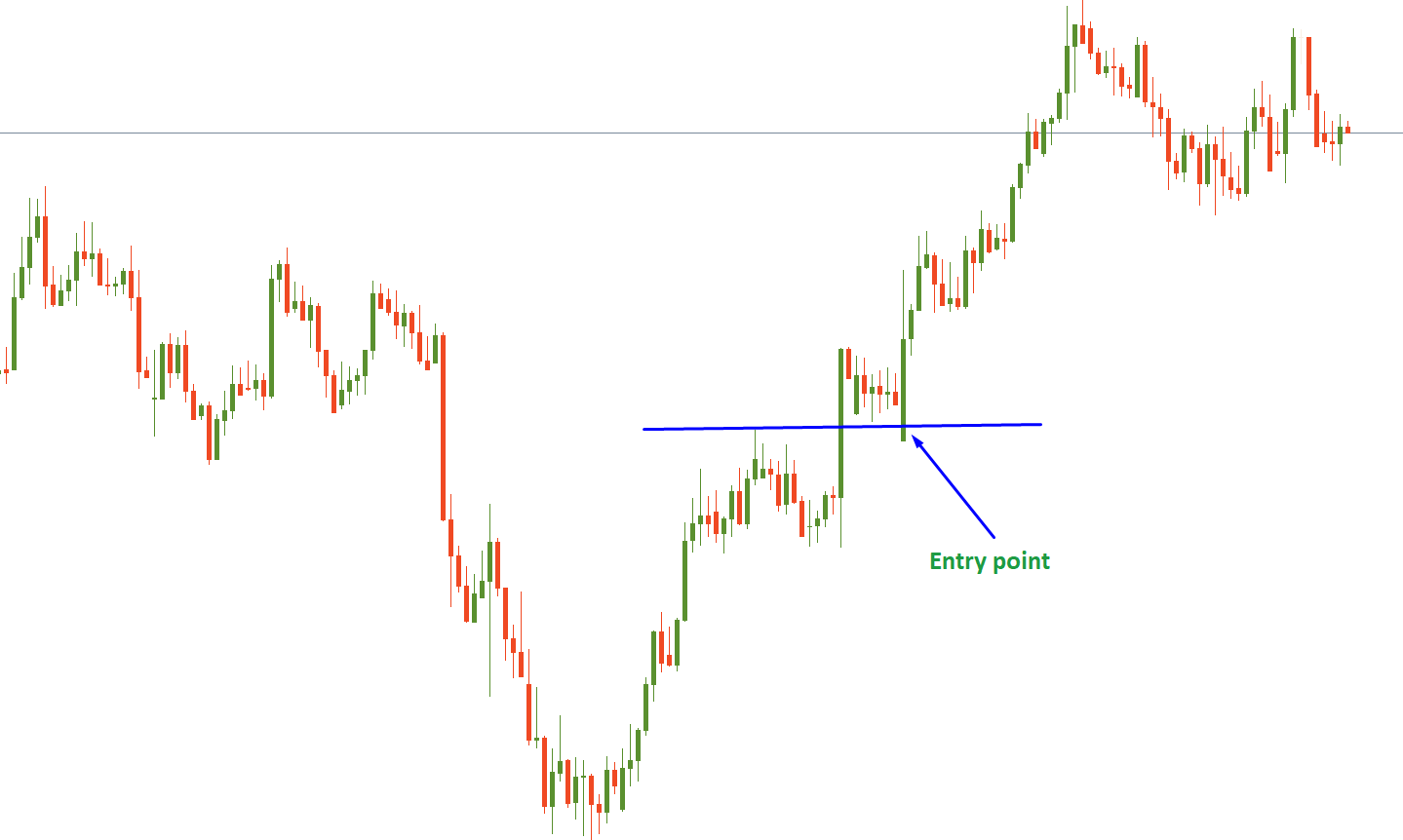

Horizontal steps

ระหว่างการเคลื่อนไหวของแนวโน้ม ราคาจะดึงกลับมาเพื่อสะสมพลังไว้สำหรับการเคลื่อนไหวครั้งต่อไปเสมอ โดยปกติ ราคาจะกลับสู่ระดับสูง/ต่ำก่อนหน้าและทดสอบจากด้านบน/ด้านล่างในระหว่างแนวโน้มขาขึ้น/ขาลงตามลำดับ การดึงกลับนี้อาจถูกมองว่าเป็นโอกาสในการหาจุดเข้าใหม่สำหรับผู้ที่พลาดโอกาสเข้าที่จุดเข้าแรก

นอกจากนี้ เทรดเดอร์ยังสามารถเลือกใช้รูปแบบขั้นบันไดเพื่อดึง stop loss ที่อยู่เบื้องหลังแนวโน้มได้อย่างปลอดภัยยิ่งขึ้น ในกรณีนี้ เทรดเดอร์จะรอจนกว่าราคาจะเสร็จสิ้นขั้นที่หนึ่งในทิศทางของแนวโน้ม จากนั้นค่อยดึง stop loss ที่อยู่เบื้องหลังพื้นที่ดึงกลับล่าสุด จากนั้น Trailing Stop Loss จะได้รับการคุ้มครองอย่างปลอดภัยและไม่เปราะบาง

Trendline pullback

นี่เป็นอีกวิธีหนึ่งที่มีชื่อเสียงในการเทรดการดึงกลับ ข้อเสียคือเส้นแนวโน้มมักจะใช้เวลานานกว่าจะรู้ว่ามันถูกต้อง คุณสามารถเชื่อมต่อจุดสองจุดได้เสมอ แต่เส้นแนวโน้มต้องมีการแตะอย่างน้อยสามครั้ง นั่นเป็นเหตุผลที่ทำไมคุณถึงสามารถเทรดเส้นแนวโน้มได้เฉพาะจุดแตะที่ 4 และ 5

มันเป็นวิธีเพิ่มเติมที่ดี แต่ใช้เพียงวิธีเดียว เทรดเดอร์ก็อาจพลาดโอกาสจำนวนมาก

สรุป

ในบทความนี้ เราได้พูดถึง 4 กลยุทธ์ในการเทรดการดึงกลับระหว่างแนวโน้มต่อเนื่อง

- กลยุทธ์เส้นสัญญาณ

- Breakout pullback

- Horizontal steps

- Trendline pullback

สามกลยุทธ์แรกสามารถใช้แยกกันได้ ในขณะที่เส้นแนวโน้มเป็นตัวเลือกเพิ่มเติมที่สามารถปรับปรุงกลยุทธ์ไหนก็ได้