Fundamental Analysis

This week, January 27-31, 2025, several events could heavily impact the U.S. dollar (USD). On Tuesday, durable goods orders for December are expected to show a modest recovery (+0.1%) compared to the previous month’s decline (-1.1%), hinting at a potential uptick in business investment. The Consumer Confidence Index (January) is projected to rise to 105.9, signalling stronger optimism among U.S. consumers.

On Wednesday, the Federal Open Market Committee (FOMC) will announce its monetary policy decision. While the market expects no changes to the 4.50% interest rate, traders will focus on Chairman Powell's tone during the press conference for insights into future rate cuts. Simultaneously, crude oil inventories data (-1.017M expected) could indirectly influence market sentiment by impacting energy prices.

Thursday brings the U.S. Q4 GDP growth estimate (2.7% vs. 3.1% prior), a key measure of economic strength. Also on the docket are initial jobless claims (forecast: 221K), which will further highlight the labour market's health. Meanwhile, across the Atlantic, the ECB is expected to reduce its benchmark rate to 2.90% from 3.15%, potentially weakening the euro and reinforcing USD strength.

Finally, on Friday, the Core PCE Price Index (December) – the Fed’s preferred inflation measure – is expected to show a 0.2% monthly increase and a 2.8% annual growth. Any surprises in this data could recalibrate expectations for the Fed's policy trajectory. The Chicago PMI (forecast: 40.6 vs. 36.9 prior) will provide additional insights into U.S. manufacturing activity.

Technical Analysis

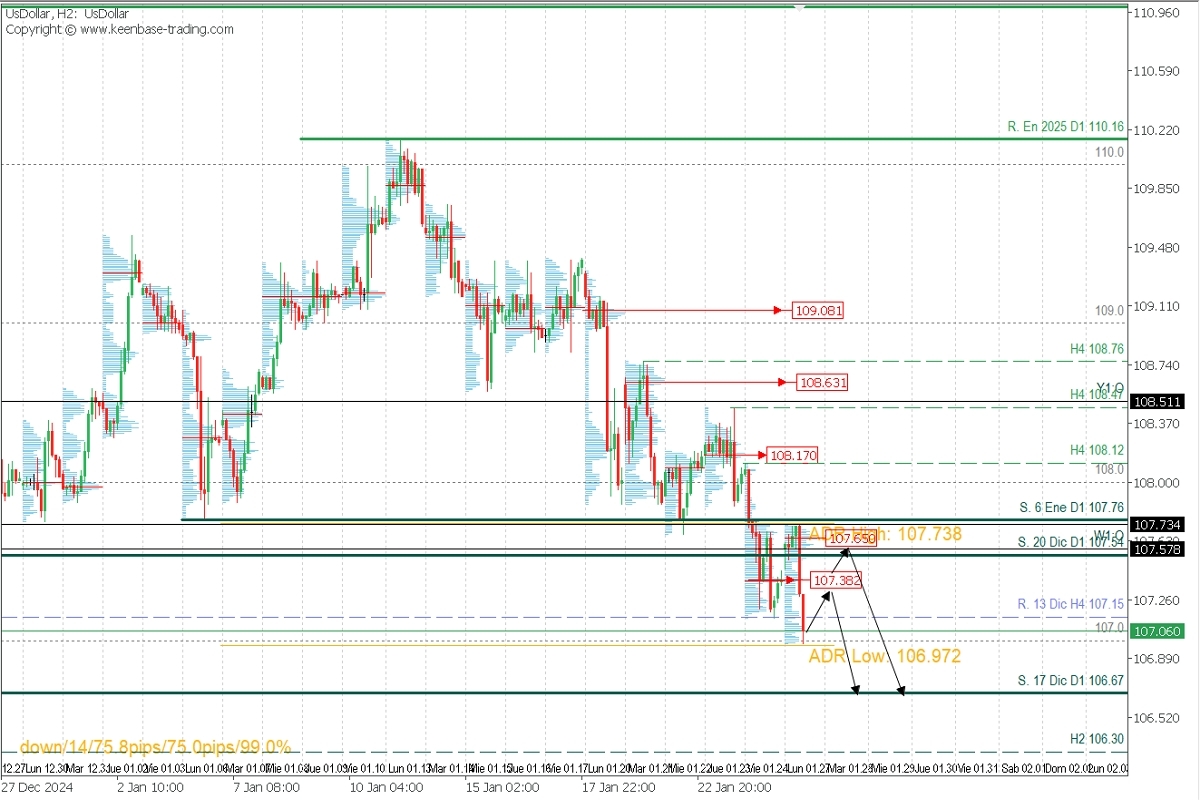

DXY (Dollar Index), H2

- Supply Zones (Sell): 107.38, 107.65, and 108.17

- Demand Zones (Buy): 106.90

The dollar confirmed the start of a bearish trend last Friday after breaking the daily support at 107.76 from January 6, turning it into a resistance level. The Asian session on Monday further validated 107.73 as intraday resistance, suggesting that as long as this level holds, the bearish trend remains intact.

Potential targets for sellers include the December 17 daily support levels at 106.67 and 106.30. However, buyers might regain control at key demand zones like 107.38 and 106.90 if bullish reversal patterns emerge.

EURUSD, H2

- Supply Zones (Sell): 1.0535

- Demand Zones (Buy): 1.0462

The pair continues to climb towards the December 17 resistance at 1.0535 amid USD weakness. Intraday support at 1.0454 remains pivotal, with buyers likely targeting 1.0550 and 1.06 if the price holds above this level. However, a decisive break below 1.0454 would signal a bearish reversal toward 1.04.

Key Scenarios

Bearish for EUR/USD:

- Sell below 1.0535, targeting 1.0493, 1.0463, and 1.0411.

- Extended targets: 1.04 after confirming a break below 1.0454.

Bullish for EUR/USD:

- Buy above 1.0480, aiming for 1.0530, 1.0550, and 1.06.

POC discovered: POC = Point of Control: It is the level or area where the highest concentration of volume occurred. If a bearish movement follows from it, it is considered a sell zone and forms a resistance zone. Conversely, if a bullish impulse occurred previously, it is considered a buy zone, usually located at lows, thus forming support zones.