The AUDUSD pair saw a sharp drop of over 130 pips today, mainly due to increased demand for the US Dollar (USD). The USD Index (DXY) surged to a four-month high after exit polls from the US presidential election indicated that Republican nominee Donald Trump was leading the race. Additionally, projections that Republicans could gain control of the House and Senate added to the Dollar's strength. A Trump presidency has raised concerns about renewed tariffs and trade tensions with China, negatively impacting the Australian Dollar (AUD) as Australia's economy is closely tied to China. Higher US Treasury yields, driven by worries over government spending and smaller rate cuts from the Federal Reserve, also boosted the USD, putting more pressure on the AUDUSD pair. However, a rally in US equity markets has led to some profit-taking on the safe-haven USD, and support for the AUD has come from the Reserve Bank of Australia's (RBA) hawkish stance and signs of improvement in China's economy. Despite this, it's uncertain whether the AUDUSD can sustain any recovery, and traders are waiting for more convincing buying interest to see if the pair can truly stabilize or if it remains vulnerable to further selling.

AUDCHF – H3 Timeframe

.png)

The price action on the 3-hour timeframe of AUDCHF recently broke below the previous low, setting a bearish sentiment. The bullish movement appears to be headed for the supply zone near 88% of the Fibonacci retracement. The supply zone provides an appropriate confluence in favor of the bearish sentiment, with the immediate target being the highlighted horizontal line.

Analyst's Expectations:

Direction: Bearish

Target:0.56968

Invalidation:0.58231

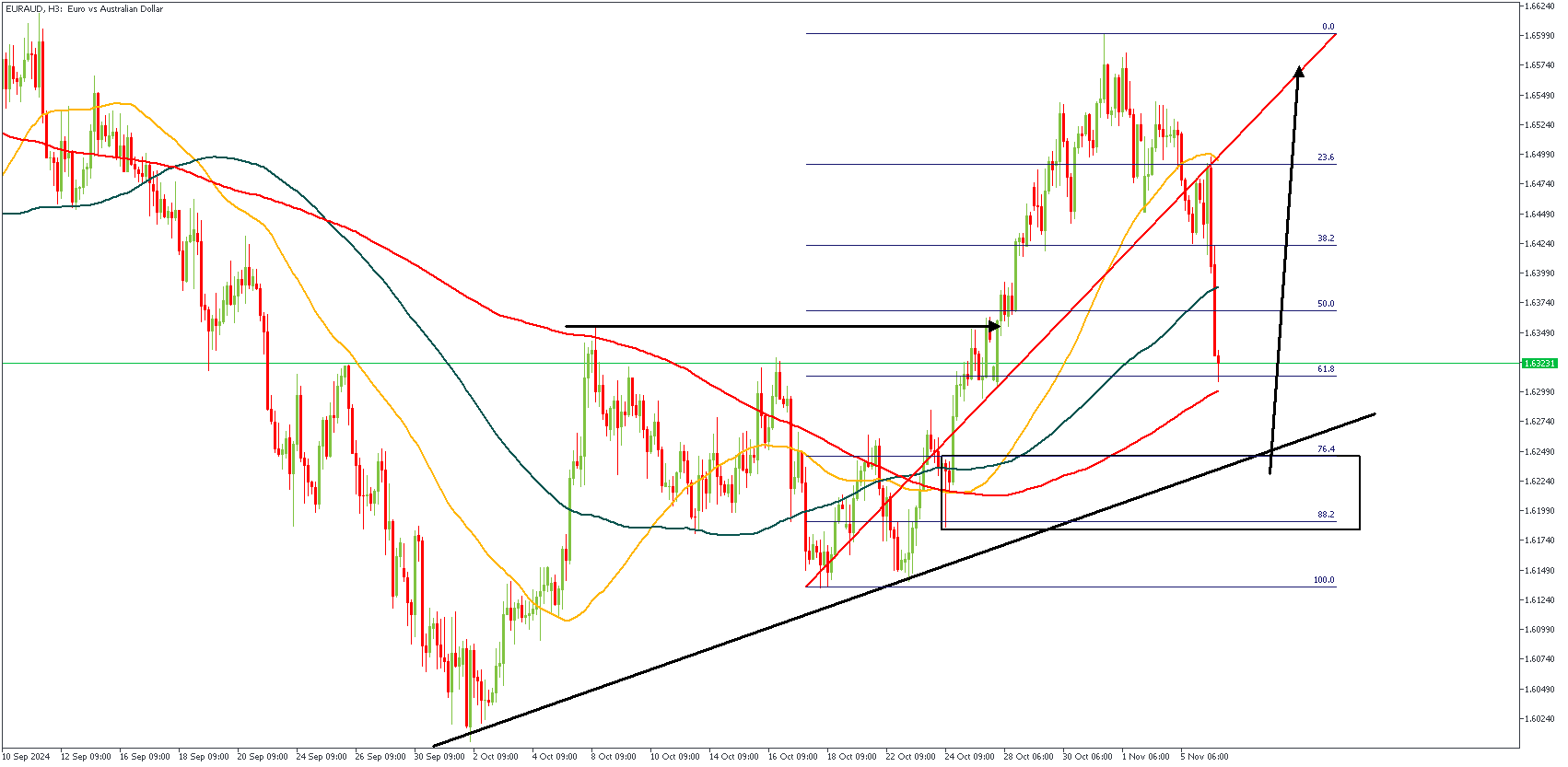

EURAUD – H3 Timeframe

EURAUD on the 3-hour timeframe has recently broken above the previous high, followed by a retracement now inching towards the drop-base-rally demand zone at 76% of the Fibonacci retracement zone. The bullish array of the moving averages, trendline support, and the drop-base-rally demand zone provide a great confluence in favor of a bullish continuation.

Analyst's Expectations:

Direction: Bullish

Target:1.65990

Invalidation: 1.61240

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.