Canada's inflation rate rose by 2.0% in October, higher than the expected 1.9% and the previous 1.6%. This unexpected increase reduced the chances of another significant interest rate cut by the Bank of Canada in December, boosting the Canadian dollar against the US dollar. Earlier, the Bank of Canada had cut rates by 50 basis points in October due to low inflation and weak economic growth.

Meanwhile, the US dollar weakened after its earlier rally, which was caused by safe-haven demand following Putin's nuclear policy announcement. However, fears eased as the US made no response to the situation, reducing concerns over an escalation in the Russia-Ukraine conflict. Traders are now focusing on upcoming US economic data to assess whether the Federal Reserve will cut rates in December. Robust data may support the Fed holding rates steady, while weaker data could lead to a more minor 25-bps rate cut.

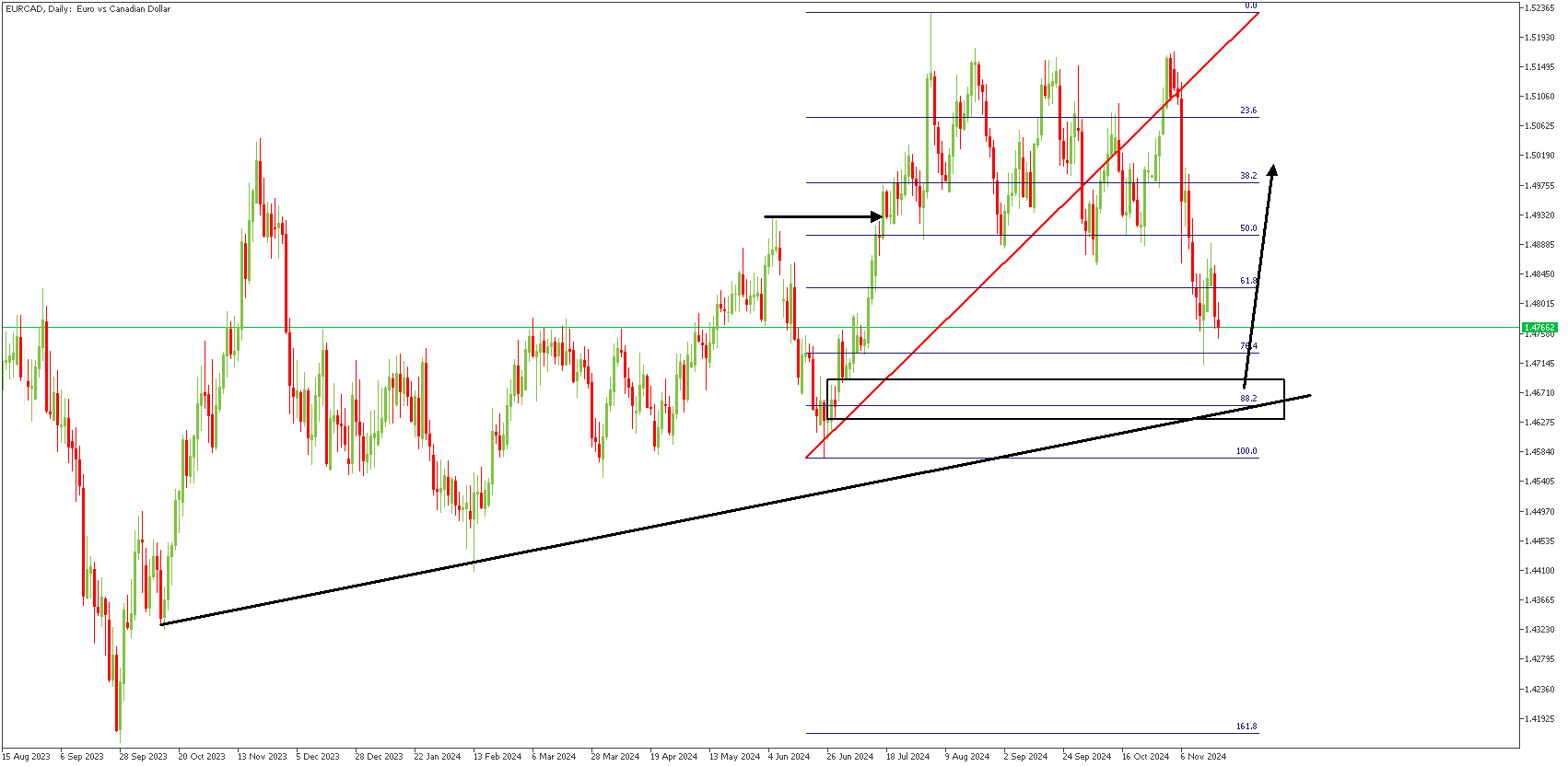

EURCAD – D1 Timeframe

The price action on the daily timeframe chart of EURCAD shows a recent break above the previous high, as highlighted by the horizontal arrow. Therefore, the price is expected to dip into the 88% Fibonacci retracement area and get pushed up due to the confluence from the trendline support, demand zone, and Fibonacci retracement level.

Analyst's Expectations:

Direction: Bullish

Target: 1.50061

Invalidation: 1.45654

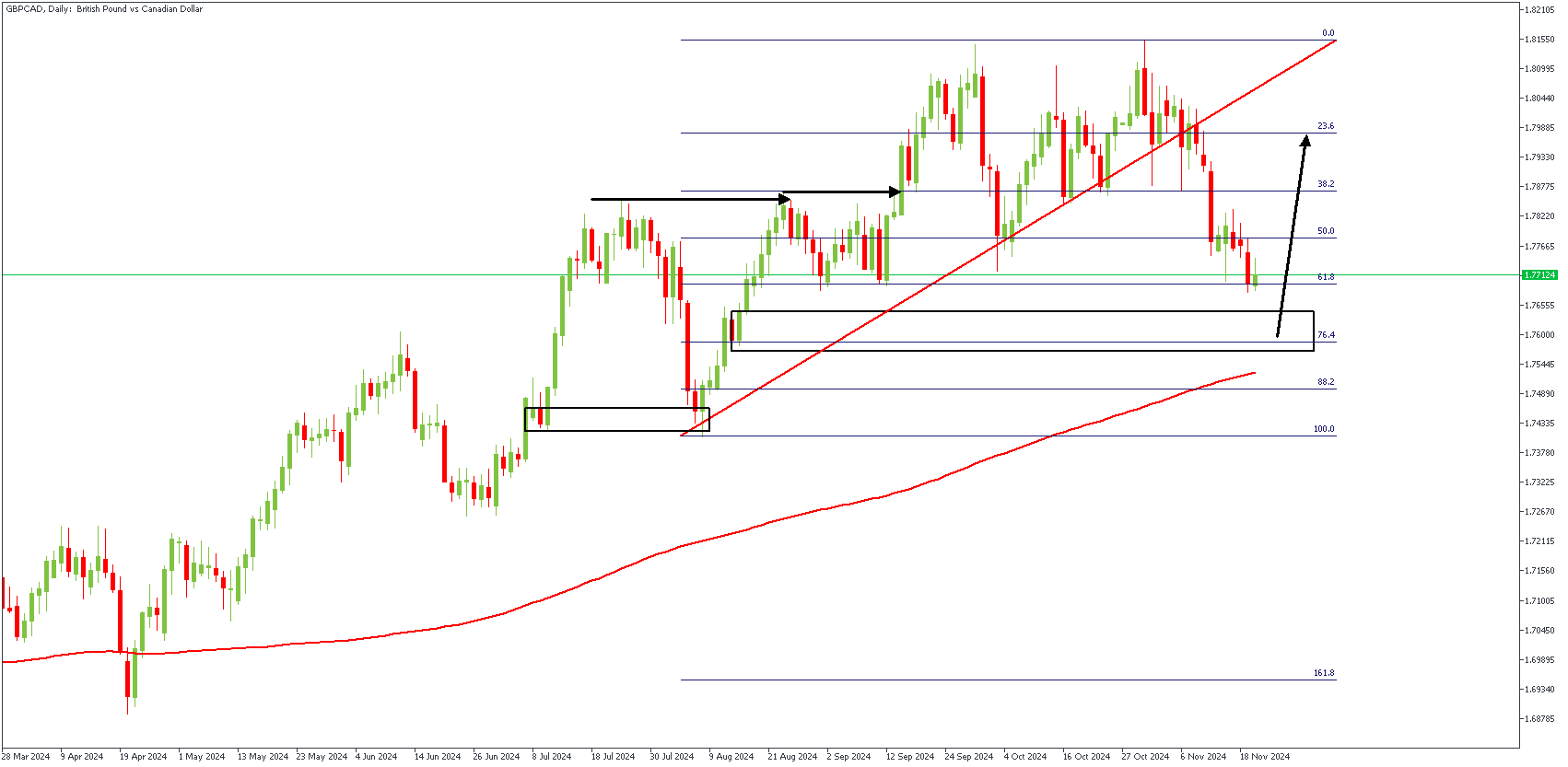

GBPCAD – D1 Timeframe

Similar to what we saw on the EURCAD chart, GBPCAD has also experienced a bullish break of structure in recent times. In this case, however, the 200-day moving average provides the primary support, while the 76% Fibonacci retracement level and the rally-base-rally demand zone provide the necessary confluence.

Analyst's Expectations:

Direction: Bullish

Target: 1.79749

Invalidation: 1.74785

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.